Are you still troubled by cross-border payments?

Do you want to shop on Chinese shopping websites such as Taobao, or 1688, but are troubled by cumbersome payment methods?

Don’t worry, this article will bring you the solution.

Payment

Two Payment Channels in Brazil

Pix

Pix is an instant payment platform created and managed by the Central Bank of Brazil, the Brazilian monetary authority, that enables fast execution of payments and transfers.

It is the first time for the new system to support peer-to-peer money transfers, cheques, Boleto Bancário payment (a payment method in Brazil), and instant payments of taxes and service fees.

Advantages:

1. It reaches more than 45 million Brazilians and increases conversion rates by providing a smoother payment experience.

2. It will change the habit of Brazilians who used to wait nearly 24 hours for payment confirmation with instant payment confirmation.

Boleto

Boleto is a payment method that uses the Bar Code identification code jointly supported by several Brazilian banks. It is dominant in Brazil, and customers can go to any bank or use online banking to authorize bank transfers.

Boleto supports over 50,000 points of sale, including gas stations, retail stores, and more. This payment method is fast and simple.

Advantages:

1. No bank account or personal account information is required.

2. Payments can be made at ATM, postal service, branch or supermarket.

3. Payments can be made at 48,000 e-banking points in Brazil.

Below are the details of payment methods, transaction fees, and more for the two payment channels in Brazil:

A Payment Channel in Colombia

PSE

PSE is Colombia’s local online banking payment, supporting 19 mainstream banks. Users can pay in real-time directly from their bank account without the need for a credit card. Because of its ease of use and security, PSE is also one of the most popular payment methods in Colombia.

Advantages:

1. Instant credit.

2. Support settlement of 19 mainstream banks in Colombia.

3. Catering to Colombians’ payment habits.

Here are the details of PSE payment methods, transaction fees and more:

Two Payment Channels in Mexico

SPEI

It is a payment method created by Banco de Mexico, and although the method was originally designed to transfer money between financial institutions, it is now open to ordinary consumers. The supported payment method is bank transfer, and chargebacks and refunds are not supported.

Advantage:

Real-time settlement: One of the main functions of SPEI is to enable real-time authorized transfers 24 hours a day, 7 days a week. Transfers are batched in seconds on a rolling timeline.

OXXO

OXXO is a very popular convenience store chain in Mexico. To make payments in the country more convenient, the convenience store chain has introduced the OXXO voucher, a barcode-printed receipt that can be paid at any of its 18,000 convenience stores nationwide. This payment method is popular for everything from paying utility bills to paying for online shopping.

Advantages:

1. Wide coverage and high awareness.

2. No bank account is required, and no personal information is required.

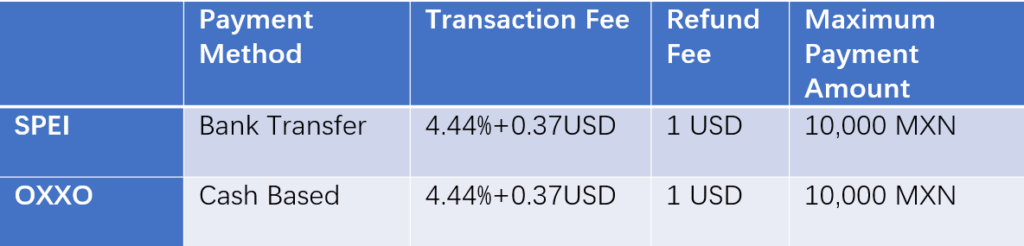

Below are the details of payment methods, transaction fees and more for the two payment channels in Mexico:

The above are five local payment channels in three countries in Latin America.

In addition to the above three countries, people in other countries in Latin America, such as Chile, Peru, Uruguay, etc., can also pay by local payments.

Yoybuy has access to the API interface provided by Payssion to support local payments in multiple countries. You can make payments for shopping and forwarding through Yoybuy.

If you have other questions about local payments, please feel free to contact us.

С сегодняшнего дня доставка в Россию полностью восстановлена.

Уважаемые клиенты, Мы рады сообщить вам, что после активной координации логистические каналы в направлении России полностью восстановлены. С этого момента при оформлении заказа вы можете

YOYBUY 2026 Chinese Spring Festival Holiday Service Schedule

Dear Valued Customers, As the Chinese Spring Festival approaches, we would like to inform you of Yoybuy’s service arrangements during the holiday period. Please refer

Celebrating the New Year: Yoybuy Service Schedule Adjustment on 23rd & 30th,Jan.

Dear Valued Customers, To foster our corporate culture and strengthen team unity, Yoybuy will be holding New Year team-building activities on January 23rd and January 30th. Please note